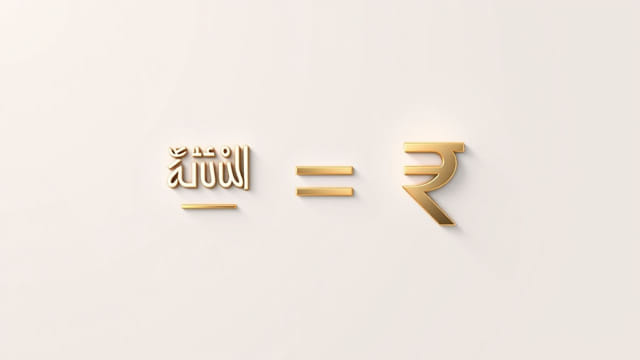

Currency exchange between the Saudi Riyal (SAR) and the Indian Rupee (INR) plays a significant role in the lives of millions of people, especially Indian expatriates living and working in Saudi Arabia. This exchange is not just a matter of economics it’s part of daily life. Whether it’s sending money home, calculating savings, or planning international travel, understanding how to convert Saudi Riyal to Indian Rupee is crucial. Currency conversion also affects business operations, import and export transactions, and even tourism between the two countries. Knowing the current rates, factors influencing them, and the best ways to make the exchange can help individuals and companies make informed financial decisions.

Understanding the Basics of Currency Conversion

What Is Currency Conversion?

Currency conversion is the process of exchanging one country’s currency for another. The value of each currency fluctuates based on a variety of economic factors. The rate at which one currency is exchanged for another is called the exchange rate. For instance, if 1 Saudi Riyal equals 22 Indian Rupees, then 10 SAR will give you 220 INR.

Why Convert Saudi Riyal to Indian Rupee?

There are many practical reasons for converting SAR to INR:

- Remittances: Indian workers in Saudi Arabia send money to their families in India.

- Travel: Indian tourists or residents traveling back from Saudi Arabia need INR.

- Business: Companies engaged in trade between the two countries need to convert currency for payments and settlements.

- Investments: Currency conversions are necessary for managing cross-border investments and savings.

How the Exchange Rate is Determined

Floating and Pegged Exchange Rates

Saudi Arabia follows a fixed exchange rate regime where the Saudi Riyal is pegged to the US Dollar. On the other hand, the Indian Rupee is a partially floating currency, meaning it is influenced by market demand and supply but occasionally controlled by the Reserve Bank of India (RBI). Since the SAR is pegged to the USD, and the INR fluctuates in relation to the USD, the SAR-INR exchange rate also fluctuates daily based on movements in the USD-INR rate.

Factors Influencing SAR to INR Exchange Rates

Several factors affect how much Indian Rupee you will get for your Saudi Riyal:

- Oil Prices: Since Saudi Arabia is a major oil exporter, fluctuations in oil prices can affect its currency.

- Inflation and Interest Rates: Differences in economic conditions between Saudi Arabia and India affect investor confidence and exchange rates.

- Foreign Exchange Reserves: The strength of India’s foreign reserves can affect the value of the INR.

- Political Stability: Stability in both countries plays a role in currency valuation.

Checking the Current Exchange Rate

Where to Find Up-to-Date Rates

You can check the current SAR to INR conversion rate using:

- Online currency converters

- Mobile banking apps

- Money transfer services

- Foreign exchange bureaus

These platforms usually provide real-time exchange rates. However, it’s important to note that the rate you see may not be the exact rate you get, as service providers often add a small margin.

Understanding Buy and Sell Rates

When converting currency, you will often see two rates: the buy rate and the sell rate. The buy rate is the rate at which the service provider will buy foreign currency from you, while the sell rate is the rate at which they will sell foreign currency to you. Always compare these rates before making any transaction.

Methods to Convert SAR to INR

Bank Transfers

Banks offer international money transfers, allowing Saudi Riyal to be converted into Indian Rupees and deposited into an Indian bank account. These are secure but might involve service fees and slightly lower exchange rates due to the margin added by the bank.

Money Transfer Services

Popular services like Western Union, MoneyGram, and online platforms like Wise (formerly TransferWise) or Remitly allow you to transfer SAR to INR quickly. They often provide competitive exchange rates and faster transfer times.

Currency Exchange Counters

If you are physically carrying cash, you can visit currency exchange counters at airports, malls, or city centers in India. Rates may vary significantly, so it’s wise to compare rates among different exchange providers before committing.

Tips to Get the Best Conversion Rate

Monitor the Exchange Rate Regularly

Exchange rates fluctuate daily. Keeping an eye on trends can help you choose the right time to make a transaction when the rate is most favorable.

Use Reputed Services

Choose well-established banks or transfer services to ensure safety and transparency. Avoid informal channels or unverified money changers, which can be risky or offer poor rates.

Be Aware of Fees

Even if a provider offers a good exchange rate, service charges or hidden fees can reduce the amount you receive. Always calculate the total cost of the transaction, not just the rate.

Regulations and Documentation

Legal Requirements

Transferring money from Saudi Arabia to India is subject to regulations from both countries. Saudi residents may need to provide documentation such as:

- Valid Iqama (residency permit)

- Passport copies

- Employment details

- Reason for transfer (e.g., family support, tuition, etc.)

In India, banks receiving foreign currency might request KYC (Know Your Customer) documents, especially for larger transactions.

Using Online Currency Tools

Advantages of Digital Platforms

Online tools not only provide live exchange rates but often offer helpful features like rate alerts, cost calculators, and even predictions based on market trends. This makes planning your transactions much easier and more accurate.

Popular Currency Converter Features

- Automatic updates with real-time rates

- Fee estimator for bank and service charges

- Historical charts for analyzing trends

Economic Impact of Remittances

Contribution to India’s Economy

Remittances from Saudi Arabia form a significant portion of India’s foreign income. Millions of Indian workers in Saudi Arabia send money home every month, which supports families, pays for education, and boosts consumption in local economies.

Stability in Exchange Rates

A stable SAR to INR rate encourages smoother financial planning and benefits both individuals and financial institutions involved in cross-border transfers.

Understanding the process and importance of converting Saudi Riyal to Indian Rupee can significantly enhance financial decision-making, especially for Indian expats and businesses operating across borders. With so many options available, from online transfer platforms to traditional bank services, it’s essential to stay informed and choose wisely. Monitoring rates, avoiding unnecessary fees, and ensuring compliance with legal regulations can help ensure every Saudi Riyal you convert delivers its full value in Indian Rupees. With a bit of planning and the right tools, currency conversion can become a simple and efficient part of managing your money.